The religion of Islam, perhaps more than any other religion, is characterized by its emphasis on scholarship (daneshmandī دانش مندی in Farsi/Urdu), on the acquiring of knowledge (ʿilm) and wisdom (ḥikma), and on the sharing of knowledge through education (Rosenthal, 2007).

The responsibility of the education (taʿlīm) of mankind is taken up by Allah [swt] Himself. Allah [swt] says, “Al-raḥmān—He taught the Quran—He created man—He taught him speech.” (The Quran, verses 55:1-4). To educate mankind with the true knowledge and to guide them to the straight path, Allah [swt] has sent messengers (anbiyāʾ), pious men (awliyāʾ), scholars (ʿulamāʾ), researchers (mujtahidīn), and teachers (muʿallimīn) to mankind, to which Allah [swt] refers as an immense bounty from Him. Allah [swt] says, “… and He has taught you what you did not know—and the bounty of Allah upon you is immense.” (The Quran, verse 4:113).

In this article, we will leverage insights from the profound Islamic scholar of India, Qutubuddin Ahmad bin Abdur Rahim, popularly known as Shah Waliullah Dehlawi on the scholastic arts of learning and education (Fann-e Danishmandī فن دانش مندی).

Shah Waliullah was born in the 18th century, and he is believed, largely due to his erudite scholarship and service in safeguarding the Islamic faith, to be the Mujaddid (Renewer) and Mujtahid (Researcher-Jurist) of his century. Shah Waliullah produced more than 50 books on various subjects, including the Quran, Hadith, fiqh (jurisprudence), taṣawwuf (mysticism) and Asrār-e Dīn (“Secrets of the Faith”). Among his many services are the translation of the Holy Quran in Persian, the language of the populace. The magnum opus of Shah Waliullah, Hujjat Allāh al-bāligha (The conclusive argument from God), is an encyclopedic work that deals with intellectual investigations into the underlying wisdom behind the injunctions of religion and covers diverse topics, including ethics, politics, and human development. Due to the profundity of his contributions and his substantial intellectual stature, Shah Waliullah has been referred to as the Ghazālī and Ibn Taymiyya of his generation.

The Art of Scholarship (Fann-e Daneshmandī)

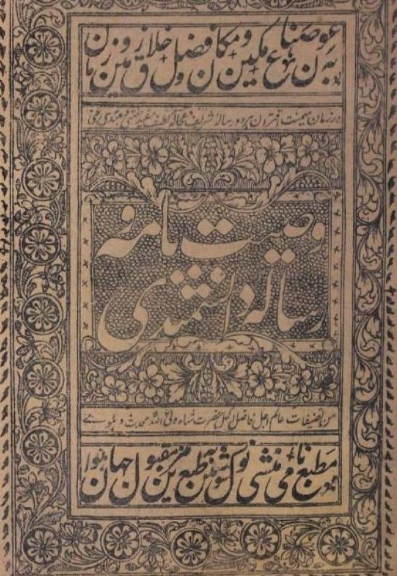

In this post, we will review the insights shared by Shah Waliullah in his book Risāla-ye daneshmandī (رسالہ دانش مندی, The epistle of scholarship), which provides insights into a rigorous methodology for education and learning. Risāla-ye daneshmandī is a valuable tract for everyone involved in the field of learning, education, and knowledge, and provides precious guidelines on how to learn and teach and acquire wisdom and knowledge. This book was authored by Shah Waliullah in Persian and was transcribed into Arabic and completed with a commentary by his illustrious son Shah Rafiuddin in the book Takmīl Al-azhān (تكميل الاذهان, The perfecting of minds).

To understand the meaning of the title Risāla-ye daneshmandī, let’s tolerate an etymological digression. The word daneshtan in Persian means “knowing”, while the word mand when used with daneshman means “one with knowledge”. The author, while explaining the word daneshmandī describes that it refers to ketāb dānī. This roughly translates into “mastery of books“, with the word ketāb referring to books and the word dān referring to being a holder or container.

According to the author, there are three levels of daneshmandī or mastery of knowledge:

1) Muṭālaʿa of books: one has read the book and has understood the meaning through realization (taḥqīq);

2) Tadrīs of books: one becomes a teacher

and communicates the reality of the books further to students;

3) Tashrīḥ of books: one writes a

commentary and excels in manifesting the reality of the book.

The author goes on to describe the benefits of acquiring daneshmandī. The first being that the student learns the art of reading a book (muṭālaʿa) and in most conditions the student’s understanding will approach the real intent of the author. The second being that the student will be able to learn the general skills that are necessary for mastering books. Since students are not taught this science, they are often averse to reading subtle books—whose meaning appears disintegrated (muntashir) to them at first glance.

The author stresses that Fann-e Daneshmandī (The Art of Scholarship) is general and applies to the rational (maʿqulāt) as well as traditional or textually transmitted (manqulāt) sciences and to demonstrative (burhānī) sciences as well as abstract (khiṭābī) sciences.

The Five Types of Knowledge Comprised by Fann-e Daneshmandī

According to Shah Waliullah and Shah Rafiuddin, the art of education and learning comprises five types of knowledge: (1) ʿIlm-e munāẓara (dialectics); (2) ʿIlm-e taʿlīm wa tadrīs (education and teaching); (3) ʿIlm-e talammuz (pupilship); (4) ʿIlm-e taṣnīf (writing/compiling); and (5) ʿIlm-e muṭālaʿa (reading).

1- Knowledge of The Principles of Debate/Dialectics (ʿIlm-e uṣūl-e munāẓara): When a person wants to benefit a non-believer through his knowledge, this is known in Fann-e Daneshmandī as ʿIlm-e munāẓara. This is relevant when we wish to educate a person who questions the basis of our thoughts and beliefs. Using ‘ʿIlm-e munāẓara one can perform the attainment of knowledge (istifāda) as well as the dissemination of knowledge (ifāda). This knowledge helps in debates, generally used in ʿIlm-e kalām (dialectical theology), or for bringing someone who does not have sound beliefs and ideologies to the straight path by the aid of Allah [swt].

2) Knowledge of The Principles of Education and Teaching (Ilm-e uṣūl-e taʿlīm wa tadrīs): When knowledge is given to someone who is obedient and willing to learn, then this is known as tadrīs (or education). To quench the thirst of the students, the prerequisite is that the teacher must intend to give benefit to the student with sincerity and Godliness (li-llāhiyat) and must remove all the things that impede the student’s learning.

3) Knowledge of The Principles of Pupilship (‘ʿIlm-e uṣūl-e talammuz): When the intention is to benefit a student who also wants to learn, then this knowledge is imparted orally face to face. With this art, the student can quench their scholarly thirst by acquiring knowledge from their teachers but with the condition that they should intend to acquire knowledge and be ready to remove all hurdles that may impede in this (otherwise the mind due to its various preoccupations will not be able to fully acquire or discharge the benefit).

4) Knowledge of The Principles of Writing (ʿIlm-e uṣūl-e taṣnīf): When someone wants to benefit the common folk, then this may be done through writing (taḥrīr) and compiling (taṣnīf) books. A student who has acquired basic knowledge but wants to expand the breadth of his knowledge and to communicate his thoughts to others should learn a lively way of writing that is able to arouse interest in the reader. (In recent terminology, this may be called the principles of journalism [ṣiḥāfa]).

5) Knowledge of The Principles of Reading and Research (ʿIlm-e uṣūl-e muṭālaʿa wa-taḥqīq): When someone wants to benefit from his/her knowledge and benefit from others’ experiences, this is known as ʿIlm-e muṭālaʿa (reading). If a person, after acquiring knowledge, wants further knowledge or wants to specialize in an area, then ʿIlm-e uṣūl-e muṭālaʿa wa-taḥqīq of Fann-e Daneshmandī are relevant. This skill can help in the continuous improvement of one’s knowledge. This knowledge has a right on every scholar and the one who does not satisfy this right is deficient and is likely to even lose the acquired knowledge. Every scholar thus should develop a habit of reading and research.

Insights on Taʿlīm and Tadrīs for Teachers from Fann-e Daneshmandī

The book Risāla-ye daneshmandī is rich in insights for educators. The author explains that if a scholar wishes to teach a book to students in a scholarly and rigorous manner, then he must necessary keep in mind the following fifteen matters.

(1) Controlling the difficult (ḍabṭ-e mushkil): The identification of difficult words in the textual excerpt (ʿibāra). This involves clarifications on grammar and orthography.

(2) Explaining the strange (gharīb): The explanation of unknown or infrequently used unfamiliar words and phrases and the clarification of their linguistic and technical meanings.

(3) Opening up the locked (mughlaq) text: The teacher must expound on the “locked” places (mughlaq) in the text. For example, the teacher must resolve the confusion that may arise if the excerpt (ʿibāra) contains a difficult phrasing (tarkīb) or an unfamiliar grammatical tense (ṣīgha).

(4) Giving examples (mithāl) and representations (taṣwīr): The teacher must clarify the issue under discussion through examples (mithāl) or by presenting various subsumed cases. For example, if the book states an abstract principle, the teacher must make it concrete by providing clarifying examples.

(5) Bringing evidence near (taqrīb al-dalāʾil): The teacher must bring the evidence closer to the student’s mind (taqrīb al-dalāʾil). For example, if the book establishes evidence for a position, the teacher must make explicit any hidden premises (makhfī muqaddamāt) and try to uncover the basic axioms upon which the evidence is based.

(6) Clear definitions (taʿrīfāt): The teacher should explain the qualifications involved in definitions. The definitions chosen should be comprehensive (jāmiʿ) of all subsumed ideas and exclusive (māniʿ) so that they may exclude other distinctive forms. The ideas should be enunciated by comparing and contrasting and by suitable conditional qualifications and extensions where appropriate (sharṭ wa-basṭ). Furthermore, these definitions should not contain any redundancies to ensure that the matter is not clouded in the students’ minds.

(7) Identification of general principles (qawāʿid kulliya): The teacher should clearly explain the general underlying principles (qawāʿid kulliya) so that students may be able to grasp the limits of the definitions, the categories, and the involved examples. These principles should be comprehensive (jāmiʿ) and exclusive (māniʿ) and should not contain redundancies.

(8) Rationale of restrictions (ḥaṣr): The teacher should explain the rationale of categorizations and explain if it is based on inductive arguments (generalizing from specific instances) or on rational or logical arguments. The scholar should also explain the reason for the sequencing of principles (qawāʿid) and chapters/divisions (fuṣūl) in the book and explain if there is a reason for their advancement (taqdīm) and postponement (taʾkhīr).

(9) Differentiation (tafrīq) of similar (mutashābih) concepts: The teacher should clearly differentiate between similar-looking but distinct things (i.e. he must perform tafrīq). For example, if two opinions are prima facie similar but different in reality, the scholar should illuminate this matter by clearly highlighting the differences so that there is no confusion.

(10) Reconciling (taṭbīq) between differing (mukhtalif) concepts: The teacher should be able to perform reconciliation (taṭbīq) between two matters that are apparently but not in reality contradicting—e.g., these two matters may be particular manifestations of the same underlying principle but in different situations. If there is an apparent conflict between two places in the text written by the author, the teacher should resolve this discordance.

(11) Removal (izāla) of potential objections (iʿtirāḍāt): The teacher should correct the potential confusions that may likely occur. The teacher should anticipate what problems the students may face and work on mitigating these possible confusions. This point is in fact the completion (takmila) of point (1).

(12) Clarification of references and differences (fī-hi naḍar): The teacher should discuss the relevance and importance of references where a reference is cited. Where the author has stated fī-hi naḍar (noted a dispute in the stated matter), the teacher should explain what the author means. If a passage is the response to an unstated question (suʾāl muqaddar), the author should clarify and highlight this.

(13) Translation (tarjama) into the language of the students: If the student’s language is not the same as that the book is written in, the teacher should translate the text into the language of the students.

(14) Reviewing (tanqīḥ) of different opinions and identification (taʿyīn) of the best opinion: When different instructions are provided/reviewed, the correct interpretation should be identified. That is, if at any place in the book there is a difference of opinion that brings a point in dispute, the teacher should review the various opinions and describe the most correct opinion. This method should also be used when resolving the potential differences of opinion on the correct interpretation of difficult words and phrases.

(15) Making the lecture easy (sahl): Lastly, the speech of the teacher must be easy to understand and the teacher must clearly and concisely explain the text in a way that is easily understandable for the students. The teacher should use brevity (ījāz and ikhtiṣār) without mixing in superfluous concepts or words for the ease of students’ understanding.

When the teacher follows the 15 instructions articulated, then that teacher will become perfect (kāmil) in lecturing and giving lessons (dars-w tadrīs) and in the explanation and elucidation (sharḥ-w tafsīr) of the book.

In another place, the author recommends that the teacher should start the process of teaching a book by first summarizing the subject matter with conciseness (ijmāl). Secondly, during explanation, the teacher can explain the intent of the author at various places. Thirdly, the teacher should tell the students that they should keep these matters before themselves during the study of a book. Fourthly, the teacher should compare the reading of the students against his own reading and correct the student where needed so that the student does not repeat the mistake in the future. Fifthly, the teacher should ask the student to write a commentary to explain the book so that the capability of the student may be tested.

Conclusion

The book Risāla-ye daneshmandī offers timeless insights into the art of scholarship and mastering knowledge that is as relevant today as it was almost three centuries ago when it was penned down by one of the Islamic scholarly giants, Shah Waliullah Muhaddith Dehlawi. This is a must read for serious students of the Islamic tradition who are involved in the business of learning, teaching, and research. In particular, the book provides specific guidelines for educators which we have reproduced in this post. For further information, the interested readers can read the book in its entirety (translated in Urdu) at https://tinyurl.com/risala-daneshmandi

References

Rosenthal, Franz. Knowledge Triumphant: The Concept of Knowledge in Medieval Islam. Vol. 2. Leiden: Brill, 2007.