On most days of Ramadan, fasting makes it impossible for me to do my usual programming and writing work. For this reason I spent most of the daytime hours of this Ramadan reading books, finishing over 20 books (mainly audiobooks).

For years I have been aware of Thomas Sowell as perhaps the greatest living African American intellectual, and this Ramadan I finally got around to reading many of his books.

Thomas Sowell is a very unique intellectual, a type that is very rare both among whites and blacks, and among blacks others like him are almost non-existent. He rejects the popular liberal ideology that presently rules in Western academia and media, and his status as a black person has enabled him to say things about racial and ethnic issues that most whites would likely not be able to get away with without being charged with racism. Sowell is, or at least tries to be, an empiricist, making him a man after my own heart. He rejects nice-sounding, feel-good political ideas for ideas that actually have merit and have been tested in the real world for their efficacy. Thus, for example, he rejects affirmative action (the practice among universities to allow blacks with lower qualifications to enter in preference to better-qualified whites), considering it harmful to blacks by making them think they should live up to lower standards than whites (among various other reasons). He also rejects the common narrative that many common problems of blacks today (such as father absenteeism and low economic status) are directly traceable to slavery, mentioning the fact that blacks in the early 20th century had much better social characteristics (such as male dedication to their families) than blacks in the second half of the 20th century.

Thomas Sowell is not, however, entirely free from bias. He sometimes strongly reflects the neoconservative bias of the Hoover Institution that he works for, for example considering free trade a highly positive thing and ignoring the technological servitude that results from it. He is also strongly invested in the Frankfurt School ideology that there are no interesting genetic-behavioral differences between different populations despite the existence of the vast literature of behavioral genetics. He also has a very strong pro-Israel stance (neoconservatism’s foreign policy views mirror Israel’s interests so exactly that they might as well have been written directly in Tel Aviv), naively thinking that the Muslim hostility toward Israel is merely anti-Semitism. He also entirely ignores the possibility that historical anti-Semitism may have had anything to do with Jewish behavior, again perfectly reflecting the Frankfurt School / neoconservative ideology.

However, Sowell has worked tirelessly to fight the pathologization of Western civilization that has been a major focus of the works of the members of the Frankfurt School and the New York Intellectuals who later emerged as the neoconservatives. Sowell has always maintained a certain independence and empiricism in spite of the influence of his milieu and his powerful intellect has enabled him to break out of important aspects of his intellectual conditioning.

I started by reading his autobiography A Personal Odyssey, one of the most enjoyable and enlightening autobiographies I have read. I went on to read his economics books Basic Economics, Applied Economics and Economic Facts and Fallacies. I then read his 1981 book Ethnic America: A History, a historical and economic analysis of the various ethnicities that make up America (the British, the Germans, the Italians, Jews, etc.). Next I read his trilogy on race and culture: Race and Culture: A World View (1995), Migrations and Cultures: A World View (1996), and Conquests and Cultures: An International History (1998).

I recently finished Black Rednecks and White Liberals (2005), a collection of essays on various issues. The most interesting aspect of this work is his study of “redneck” culture. According to Sowell, redneck culture originated in Britain and was characterized by high criminality and violence, a lack of interest in education, pride, grandiosity and sexual promiscuity. Redneck migrants from England brought their culture with them and established themselves in the American South, repeating the same behaviors that they were famous for in Britain.

Since nine tenth of black slaves lived in the South, they had the unfortunate fate of being acculturated to this redneck culture. Therefore according to Sowell, things that we consider to be “black” culture today (such as gangster rap and a low opinion of education) are actually the redneck culture of Britain that blacks took in. Blacks that were freed in the 19th century and lived in the North abandoned this redneck culture and took in New England’s extremely different (and far more productive) culture, so that these blacks were far more prosperous and educated and suffered far less from the problems that plagued both the whites and blacks of the South. He mentions that once “redneck” Southern blacks started to migrate en masse to the North, the New England blacks looked down on them and would do their best to move out of neighborhoods that these newly arrived blacks lived in, just as the whites did.

Another interesting topic that he covers in his highly unique way is slavery. Rejecting the common Western narrative that the West was somehow uniquely evil in its practice of slavery, Sowell says that slavery was a global phenomenon, and that Western civilization was actually the one that was almost entirely responsible for abolishing it. In the 18th and 19th century the British developed the idea that slavery was morally wrong and unacceptable, and they started to spend vast resources fighting it. The British started to patrol the seas with their ships, fighting slave traders around the world. This British crusade against slavery has been largely forgotten.

Islam and slavery

It was the British who forced the Ottoman Empire to ban slavery. Despite Islam’s humane attitude toward slaves and its strong encouragement for freeing them, it is a fact of history that slavery in the Islamic world represents one of the greatest moral failings of our civilization. We now realize, thanks mainly to Western civilization, that the most Islamic attitude toward slavery is tolerating it with the explicit goal of working to eradicate it. But throughout the centuries, Muslims failed to put this program into practice, instead representing one of the greatest forces supporting slavery throughout the world by creating a strong demand for it. Muslims happily purchased slaves without worrying about how these slaves were created in the first place: the extremely inhuman process by which African, Arab and European slave-raiders acquired slaves to be sold in the Islamic world.

It is not much to be proud of that Islam had very important protections for slave rights when it had nothing to say about how these slaves were acquired in the first place. By creating a vast market for slaves, the Muslims encouraged mass slaughter of Africans and Europeans by cruel slave-raiders. It is amazing to think that all of these Muslims, despite the high morality that the Quran and hadith taught them, did almost nothing about this incredibly unjust and oppressive system until the British came along to civilize them.

Islam and interest

As an economist, Thomas Sowell considers the charging of interest an essential part of the functioning of any well-developed economic system. To him, therefore, the fact that Islam forbids interest is just an ignorant and foolish prejudice that misunderstands the function of interest. Interest makes it possible to mobilize the wealth of society by encouraging the wealthy to use their money to fund economic growth. If people place their savings in the bank, and the bank lends this money to corporations that can invest the money in various economic projects, this makes it possible to mobilize a vast amount of society’s wealth in the service of economic projects.

What Sowell does not realize is that it is perfectly possible to do this without interest. It is, however, true that the ban on interest was a great limiting factor on economic growth in the Islamic world until Muslims learned in the 20th century that it is possible to create the Western pattern of wealth mobilization without interest by creating Islamic banks.

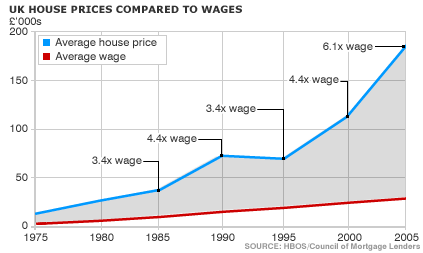

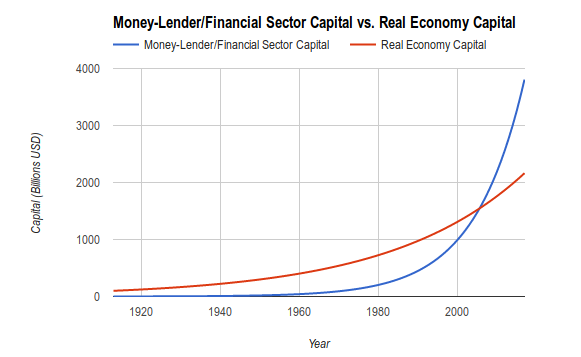

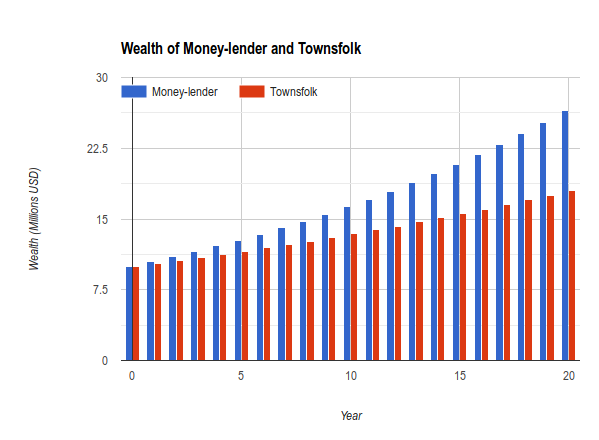

But now that the system is in place, the ban of interest is no longer a limiting factor on economic growth. Islamic finance makes it possible to mobilize society’s wealth without the use of interest through the ṣukūk system, enabling the creation of a financial world that is far more humane and borrower-friendly than the current, usurious Western financial system. For example, in an Islamic home mortgage, no loan is involved, and in the case of default, the home buyer always gets money back. Compare this to the Western system where default means not only losing the home, but sometimes owing hundreds of thousands of dollars to the bank. This incredibly unjust usurious system of the West makes it practically certain that the wealth of the bankers will continuously grow at a faster rate than the wealth of society, making the bankers the richest and most powerful people in the country, as has happened in the West. See my essay: Why the Banks are So Powerful and Why the Bible and the Quran Forbid Usury: Charting How Interest Creates Obscene Wealth Inequality.

Middleman minorities

A big focus of Thomas Sowell’s work is on so-called “middleman minorities”. These are ethnicities such as the Jews in the West, the Chinese in Malaysia, Indonesia and other Southeast Asian countries, and the Lebanese and Indians in Africa. Middleman minorities all share certain attributes:

- They are generally wealthier than the native population.

- They are clannish and keep to themselves, maintaining a separate culture from the native population.

- They keep ties with their home countries and build international trade and financial networks with their co-ethnics.

- They are often involved in money-lending.

- They often monopolize entire sectors of the economy.

Middleman minorities have invariably been resented by the native population, who envy the wealth, success and power of the middleman minorities and dislike their separate, clannish existence.

According to Sowell, it is only prejudice and envy that makes native populations dislike middleman minorities since these minorities serve essential functions in their economies. For example, the Chinese in Malaysia are responsible for developing various sectors of the Malaysian economy, sectors that would have been far less developed, and perhaps even non-existent, if the Chinese had not been there. According to Sowell the middleman minorities create the wealth they enjoy. They do not exploit the native population and do not steal their wealth.

So why do natives dislike middlemen? Why were Jews so universally hated in Europe when they served such “essential” economic functions? Why did the Ugandans expel the Indian and Pakistanis who had helped build up so much of their economies? Why do Malaysians and Indonesians so dislike the Chinese among them?

Genetic-cultural altruism

Thomas Sowell’s unsatisfactory answers to the above questions are a very good illustration of the way specialization limits the intellectual horizons of specialists. Being an economist, he thinks of middleman minorities largely in economic terms and sees their positive contributions as more than justifying whatever else the presence of these middleman minorities may entail.

But an evolutionist is going to have a very different view of the clash between natives and middlemen. From an evolutionary perspective, ideally everyone you do business with will be your father. Genetic relatedness makes people more kind toward their own kin than towards strangers. And this behavior comes out on a daily basis in the interactions between the natives and the genetically separate middlemen.

When you need a loan from a bank, rather than going to someone from a strange land and culture who probably dislikes you and has no love for you, you would much rather go to the bank that is run by your father. You know you will be treated with much more sympathy, love and respect.

When you are desperate for employment, you know that your father will be much more likely to employ you than a random stranger who only thinks of you in economic terms.

Middleman minorities are a jarring element in the social fabric of the natives’ society. The natives want to be treated as kin, as humans, by their fellow humans. But middleman minorities only think of the natives in economic terms, dehumanizing them into mere tools of economics. This is an incredibly disorienting, degrading and alienating experience for a native. By being an impermeable, non-kin group, we know that middlemen deal with us only according to the harsh, cold laws of economics, rather than dealing with us as family.

The clannishness of middleman minorities only exacerbates the problem. By creating an impermeable group that deals with its own members charitably while dealing with natives as excluded aliens, they make the population feel as aliens in their own hometowns and countries. This is highly disconcerting. To go from the loving atmosphere of your own kin and ethnicity to the cold atmosphere of the alien middleman is never a pleasant experience.

The solution, the only solution, is for the middleman minority to go native by making their group permeable. Middleman populations such as historical Jews that are stringent about preventing intermarriage and cultural exchange are guaranteed to provoke extreme hostility by making the native population feel like aliens in their own lands. On the other hand, middleman groups that intermarry and become part of the native population both genetically and culturally will end all possible hostilities within a few generations, as happened with the Arab settlers in Southeast Asia (compare with the hostility that the Chinese provoke there nowadays). The Arabs intermarried and became part of the population. Despite their great economic success and their maintenance of familial and economic ties with the Yemeni coastal areas that they came from, they provoked no hostility that I can discover.

While middleman minorities may make the economy more efficient by their activities, they also make it less human by remaining alien, impermeable and clannish and having an us vs. them mentality toward the native population. The various expulsions of middleman minorities throughout history show that people would much rather enjoy a less efficient but more humane economy run by natives than a more efficient but less humane economy run by middleman minorities.

An economist like Thomas Sowell thinks that the natives should simply swallow their pride and their desire to be treated with the dignity that kin treat them for the sake of having clannish middleman minorities make their economies more efficient. This may make sense economically, but it makes no sense from a wider, human perspective.

The indignity of separatism

Middleman minorities, by the very fact of refusing to intermarry and assimilate with the natives, tell the natives on a daily basis that they consider themselves superior: the natives are simply not worth marrying. This is incredibly degrading to the natives. By considering themselves a superior genetic-cultural stock, the middleman minorities constantly stress the inferiority of the natives upon their psyches. It is highly naive to expect the natives to be content with this state of things. To the natives this is an itch that cannot be scratched. And the increasing success and prominence of the middlemen only serve to remind the natives of their own inferiority.

The main problem with middleman minorities is not that they are genetically different from the natives, but that they work to maintain this genetic difference. A native does not need to be an intellectual to realize that this maintenance of genetic separatism is a judgment on his or her ethnicity. They know that they are treated as not being good enough. And that, in turn, leads to their developing a group identity of superiority over the middlemen: if you treat me as inferior, I will treat you as inferior. This leads to the stressing and exaggeration of the negative qualities of the middlemen among the natives. They are avaricious, uncharitable, selfish, lacking common decency, inhuman. The natives develop an ideology of ethnic pride that justifies to themselves their right to fight back against being treated as inferior, and this in turn leads to the natives calling for laws discriminating against the middlemen, boycotts, and even violence.

So the question is this: do middleman minorities have a moral right to practice business in an alien nation while maintaining genetic and cultural separatism? I believe this is a question that only the natives can decide for themselves. If the value that the middlemen offer is so great as to be worth the indignity of tolerating them, then the natives can choose to do so. And if the value they offer is not that great, they can choose to expel them. While economically the second choice may not make “sense”, from a psychological and evolutionary perspective, it makes perfect sense.

While we can feel sorry for the many innocent people who have been harmed in riots and expulsions, we cannot ignore the reality that their separatism is directly responsible for this treatment.

To put it another way, the natives have a moral right to demand to be treated as equally worthy by the middleman minority, and that, above all, means that the middleman minority must cease its clannishness and separatism and must start to intermarry with the natives. Middleman minorities that have gone this route, such as the Japanese in the United States, have completely ceased to be an issue, while middleman minorities such as the Jews in the United States, who have continued to work hard to fight intermarriage, continue to provoke some hostility. The Koreans working in black ghettos in the United States also provoke hostility due to their maintenance of genetic separatism from the blacks they serve.

Sowell may say that the middleman minority has a good reason to remain separate: the natives have an inferior culture. The Chinese, for example, say that the Malays are lazy and less reliable. But the Chinese could marry the Malays and attempt to fuse their supposedly superior culture with that of the Malays. Even if this involves sacrificing aspects of their superior culture, it may be the only reasonable way forward to end the conflict

The solution for the ethnic conflicts that have plagued Southeast Asia is for the governments of these countries to strongly promote intermarriage. In Thailand, due to the fact that the Chinese and the Thais share the same religion, intermarriage has been more common and with it the hostility toward the Chinese has been less pronounced. But in Indonesia and Malaysia, where the Buddhist-Muslim difference is a significant barrier to intermarriage, hostility has been much more pronounced. These countries can greatly reduce the conflict by passing laws that treat the Chinese as natives if they are married to a native.

A significant new middleman minority population are the Chinese in Africa. It is essential for African countries to instate policies requiring intermarriage in order to prevent the same sordid story of riots, pogroms and expulsions that have plagued the history of middleman minorities throughout the world. Unfortunately African nationalist ideas in some countries make the officials of these governments (such as in Uganda) hostile to the idea of intermarriage, a very unconstructive attitude that will only set up the stage for ethnic conflict.