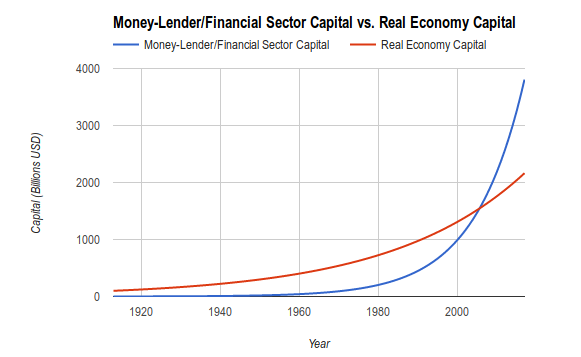

Imagine if in 1913 the real economy of the US had $100 billion in capital, while the banks and money-lenders had only $1 billion. Given everyday economic circumstances, by 2017, the wealth of the real economy would have grown to $2163 billion (with a 3% economic growth rate). Meanwhile, the wealth of the banks and money-lenders during the same period would have grown from $1 billion to $3806 billion. Starting at only 1% of the wealth of the real economy, within just over 100 years, the financial sector grows to 175% the size of the real economy.

This is the heart and soul of usury; the reason why banks are so powerful, and the reason why usurers have been hated with visceral hatred throughout history. The usury sector uses the law to enforce an alternate reality where their profits grow faster than the real economy. If they were honest investors, their money would be directly invested into the economy, so that their wealth would grow (and shrink) with the real economy. But through the hateful invention of usury, they create an alternate reality where their wealth always grows faster than the real economy.

The chart assumes a relatively low business loan interest rate of 5%, and a high delinquency rate of 6.75% (the highest recorded by the St. Louis Fed between 1987 and 2016), and a high (usurer-unfriendly) reserve ratio of 33% (the lower the reserve ratio, the faster the wealth of money-lenders grows, as they earn more interest on their capital).

The chart assumes a relatively low business loan interest rate of 5%, and a high delinquency rate of 6.75% (the highest recorded by the St. Louis Fed between 1987 and 2016), and a high (usurer-unfriendly) reserve ratio of 33% (the lower the reserve ratio, the faster the wealth of money-lenders grows, as they earn more interest on their capital).

Usury is evil because, on a macro scale, it passes off most risks to the borrower, and most profits to the lender. In the world of business, businesses sometimes make a profit, sometimes make a loss. But in the world of usury, usurers always make a profit. They lend money at 5% to a business and demand 5% profit after the year with complete disregard for whether the business profited or made a loss.

In this way, usury turns the whole economy into a casino where the usurers win most of the time. They happily lend money to everyone they can burden with debt then demand profits (interest) at a fixed rate without regard for the fact that in the real world people sometimes profit, sometimes make losses. The usurers live in a parallel reality where they always profit.

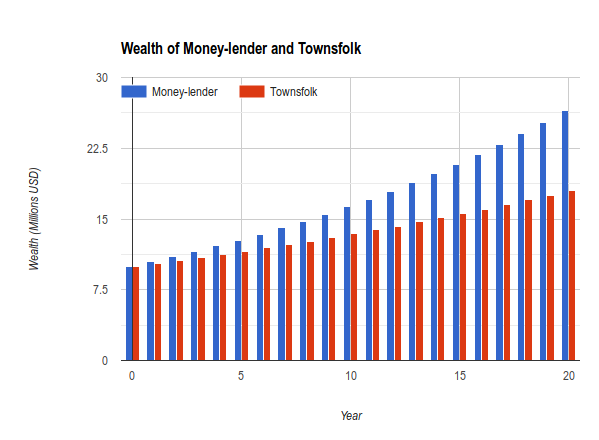

In this way, the wealth of usurers grows faster than the wealth of the rest of society, enabling them to slowly but surely take control of the whole economy by buying up its lands and businesses. Below is a chart of this process over 20 years in a small town, assuming both the money-lender and the townsfolk have $10 million at the beginning.

A wealthy usurer looks at a fellow human and thinks, “How can I turn this person into a profit-making tool for myself?” They want to give him $10,000 to take risks with, but they want to charge him 5% annual profit regardless of whether he profits or loses. In this way they drive a wedge through reality; most profits to the usurer, all losses to the borrower. They do not want to honestly invest their wealth (such as by starting businesses), because they may lose. Instead, they give their money to you so that you will lose if things go badly, while enjoying the power of the law in extracting their profits from you year after year regardless of your loss.

The usurers at the Federal Reserve, Wall Street and the Chicago School of Economics would have you believe that the above situation is unavoidable, that it is just a fact of life, and that if you dislike money-lenders for their profiteering and rent-seeking, you are just hating them for their wealth.

What is not mentioned is that there is a way for the wealthy to invest their wealth without creating wealth inequality and giving themselves such an obscene advantage over the population, and that method is simply honest investment, what I call Socratic Finance, as Socrates mentions it in Plato’s Republic. It is to make the lender and the borrower share in their fair portion of risk and gain.

How is this magic performed? By prohibiting the charging of interest. When the charging of interest is prohibited, money-lenders are made to invest in the real economy, and to share in its profits and losses. If the town’s money-lender cannot practice usury, and has $10 million in wealth compared to the town’s $10 million, he would be forced to spend his money investing in the real economy by buying businesses or starting new businesses, creating jobs in the process, and raising wages, as he has to compete with other business for available talent. In this way he shares in the town’s profits and losses, instead of enjoying a 5% guaranteed annual profit rate that has nothing to do with reality, that is just a legal fiction designed to enrich him at the expense of his borrowers.

If he wants to invest his money to finance housing, instead of using the corrupt practice of mortgaging, he would offer up houses on a rent-to-own basis. In a normal mortgage, a person is made to carry the burden of a $300,000 loan while the money-lender continues to own the house. In the case of default, the money-lender gets the house back, sells it, and if it sells for less than the outstanding loan amount, he goes after the borrower for the rest of the principal. Most mortgage defaults happen during times of financial crises, when people lose jobs, and when houses lose value. If the home was mortgaged at $300,000, during a crisis it would sell for only $200,000. If the buyer had paid $20,000 of the principal off, they would lose the house, and still owe $80,000 to the usurer.

But Socratic home financing is a world apart from this. If a person gets a Socratically-financed home, and then is unable to make payments, the investor gets the house back and sells it, and the home-buyer gets his principal share of the house back. If he had paid off 20% of the principal, he would get 20% of the house’s sale price. In a Socratically-financed home, the buyer always gets some money back in the case of default, as there is no loan involved, it is real ownership transfer of the house. In the previously mentioned case of the $300,000 house, the buyer would get $40,000 back after foreclosure, instead owing $80,000.

Over the past 400 years, most Christians have continued the tradition of being utter disgraces to the name of Christ, so that today even the Vatican funds its operations through usurious lending. Even the Amish practice usury.

If but a probable suspicion arose

of a man to occupy that filthy trade

He was taken for a devil in the likeness of a man.

But good Lord, how is the world changed?

That which infidels cannot abide, Gospellers allow,

That which Jews take only of strangers

and will not take of their countrymen for shame,

That do Christians take of their dear friends

and think for so doing they deserve great thanks.

Thomas Rogers (Anglican theologian, ca. 1555-1616)

Today’s usurers try to absolve themselves from their sins, and whitewash their actions, through the practice of philanthropy. Almost every wealthy usurer is described as a “philanthropist” on Wikipedia. They gain billions of dollars by squeezing the life out of the economies that play host to them, using usury to drive a wedge into the economy and extract rent from it, then spend a few hundred million dollars funding hospitals, museums and universities, and lo and behold! They are philanthropists. It is to this usurer trick of philanthropy that Rabbi Hermann Adler, Chief Rabbi of the British Empire from 1891 to 1911, refers when he says:

No amount of money given in charity, nothing but the abandonment of this hateful trade, can atone for this great sin against God, Israel and Humanity.

The Risk-Profit Differential

The evils of usury, and the immense urge that usurers feel to practice it, can all be summed up into one phrase: the risk-profit differential.

Whatever reasons usurers bring up to defend usury can be defeated by mentioning this phrase. The risk-profit differential is the core of usury, the reason why usurers prefer usury over productive investment, as was recognized by Jesus in his Parable of the Talents.

The risk-profit differential refers to the fact that, at its core, every usurious contract is about passing off more risk to the borrower than to the lender, and passing off more profit to the lender than to the borrower. This differential, this unbalanced arrangement that constantly pushes risk away from the usurer while also constantly pushing profit toward him, is where the attraction of usury lies.

It is the desire of every human to want to increase profits while also wanting to decrease risks. A usurer is simply someone selfish enough to create an arrangement that puts this unchecked, selfish animal desire into law through a contract that ensures him more profit and less risk, while also ensuring less profit and more risk to the borrower.

Usury is about enforcing a contract that enslaves the borrower to the usurer’s interests. The usurer class ensures itself a constant rate of profit (the class as a whole always profits, never loses), while the borrower class profits and loses randomly as economic conditions demand. The usurer class gets guaranteed profits. The borrower class is forced to share its profits with the usurers, while also being made to keep its losses to itself.

Through this unbalanced arrangement, the wealth of the usurer class balloons. They build skyscrapers to house their banks and insurance companies. The rest of society’s prosperity grows fast at first, then stagnates, and then starts to decline as the debt load grows, until a situation is reached, like that in the US, where bankers and their friends are the richest and most powerful people in the country, almost living in alternate reality, with lavish lifestyles and massive mansions subsidized by the interest payments of the millions of peasants.

Casinos make profits by having machines that win very slightly more often than they lose. Perhaps winning 52% of the time and losing 48% of the time. Usury, through the risk-profit differential, turns the entire economy into a casino where the usurers win 80% of the time, and lose 20% of the time (through defaults and bankruptcies). While a large casino makes a few billion dollars a year for its owners through its rigged nature, the economy, due to the rigged usury, makes trillions every year for the usurer class.

Usury is an unbalanced arrangement, otherwise it wouldn’t be usury. There is no way to make usury fair, to make it harmless, to make it add positive value to society. The only solution to usury is to ban it, as the English Kings Edward I and Edward VI did.

No matter how many clever arguments the usurers and their economists come up with in defense of their usury, they can never make this fact go away, as this is the only reason a usurer practices usury: he wants nearly all profits to come to himself, and nearly all losses to go to his borrowers. He wants to give his money to a peasant who is legally forced to share his profits with the usurer while bearing the full burden of any losses.

Debt slavery

The problem with usury is that the profits of lenders always grows faster than the profits of borrowers. When you borrow $10,000 at 5% interest, within this transaction is the embedded assumption that your prosperity will grow by at least 5% in the next year. This is why Aristotle and many other philosophers and intellectuals call usury “unnatural.” The profits of usury are separate from the profits of the actual economy in which it exists. When usurers lend at 5%, they are maintaining a parallel alternate reality in which the economy profits at 5% in the next year, regardless of whether the actual economy profits at 5% or not.

While some borrowers make good use of the money they have borrowed and make more than 5%, so that they can pay off the usurers and still make a profit, others, because of the millions of chances that operate in the reality of an economy, make a loss on the money they have borrowed. They may have borrowed $10,000, and a year later they only have $8,000 left, because their business dealing didn’t work out as they expected. But the usurer, in his alternate reality, continues to pretend not only that the $10,000 still exists, but that the $10,000 made a 5% profit. He collects $500 from the borrower at the end of the year, leaving the borrower with $7500 in cash, and a $10,000 debt to pay off. If the borrower continues to be unlucky the next year, he loses another $2,000 of his cash, but he still has to pay about $500 to the usurer, so now he has $5,000 left in cash, and a $10,000 debt to pay off.

Meanwhile, during these two years, the usurer has earned $1,000 in profit, without losing any of the $10,000 he gave to the borrower, since the borrower is required to pay it back regardless of his or her profits or losses.

Usury is a way of earning money by the virtue of having money, while making others carry the burden of any risk that comes out of using the money. It is an amazing deal—for the usurer. For the borrower, sometimes it is a good deal, sometimes it breaks even, and sometimes it is pure slavery.

A modern, poignant form of debt slavery today is student debt. A usurer lends a student $100,000 at, let’s say, 5% interest. Within this debt is the assumption that not only will the student be able to use their $100,000 degree to earn that much back over their career, but that they will also make a 5% profit, every year, over and above the cost of the degree.

As it happens, some students graduate and succeed in the business world, so that they pay off the loan in 10 or 15 years while enjoying a good, or at least an acceptable, standard of living.

But for many students, this is only something that they can dream of. They borrow tens of thousands of dollars, only to spend the rest of their lives barely being able to make the monthly payments on their loans. And ten years after graduation, due to changing economic, political or technological conditions, their degrees may be completely worthless, meaning that they racked up $100,000 or more in debt for something completely useless. This $100,000 will hover over them like a dark cloud for the rest of their lives.

Meanwhile, the usurer in his or her high tower, continues to extract a 5% interest, or $10,000 a year, from the student, with the law enabling them to maintain an alternate reality in which that completely useless degree is actually worth $100,000, and also that that useless degree is enabling the student to earn a 5% yearly profit over the value of the degree.

In 2015, there were 2.8 million Americans over the age of 60 who were still living with student debt. US law, authored by usurers and their lobbyists, prohibits these people from declaring bankruptcy so that they can get rid of this cloud that has been giving them constant stress since their early adulthood. The law forces them to pay it off, and empowers usurers to seize these people’s wages and properties to get not only the original $100,000, but an additional $10,000 yearly profit over and above that for every year these people have had their debt, which, for a person of 60, means for their entire adult lives. Student debt has turned these people into money-making machines for the usurers.

Usury is about creating an alternate reality in which the economy profits at 5%, or 20%, or whatever the usurers are currently lending their money at, and using the law to force this reality on the population, regardless of the actual economy.

In the real economy, each year and each month’s profits are different from the previous ones’. One year the economy may make a 5% profit, another a 2.5% profit. A war may break out, or natural disaster may strike, causing the economy to make a loss. Political conditions can change. Trade wars, currency speculation and terrorism can severely damage an economy’s profits.

But in the blissful alternate reality of the usurer, none of this happens. Each year is full of sunshine and great harvests, and the population will have to subsidize this alternate reality for them.

FOR GOVT. OF PAKISTAN AND OTHER COUNTRIES