Introduction

There is a surprising amount of confusion among the religious, even among clerics and scholars, when it comes to understanding why evil exists and why God stands aside when so much suffering happens throughout the world. Most of us express wonder when we see some horrible catastrophe happen, or when we see evil individuals, companies and institutions wield so much power. Some people even go so far as to blame God for the evil things that exist in this world, since if God had desired, He could have prevented such things from existing or happening in the first place. Others take this even further, using the existence of evil as proof of God’s non-existence. How can a good and supposedly all-powerful God stand by while so much evil happens? Where is our God?

There are good, perfectly logical explanations for these things, deep explanations that elucidate the purpose of this universe, our place in it, and our relationship with God, and through this give us perfectly good reasons for the existence of evil.

Why Evil Exists

What is the point of the existence of this world anyway? Many mistakenly think that the purpose of this world is to be a permanent residence where people judge whether God exists or not. They think that they can gauge God’s “level” of existence by the things that happen around them, so that given the right set of events, they will decide He is alive and active, and given others, they will decide He doesn’t exist, because if He existed, the world wouldn’t be the way it is.

A friend said that he once went on a trip abroad, and before he left, he asked God to protect three things that were most important to him in his life. During his trip, he lost all three, which included the dying of loved ones, and this made him decide that God doesn’t exist. He is a Buddhist now.

The above case is an example of earth-centric thinking, that considers this world a goal in itself. This is the core mistake that leads to millions of people misunderstanding, even disliking, God. That is a mistake because this world is nothing besides a testing hall where humans can freely choose to do as they like, to prove their worthiness of God’s approval or wrath. This world is not meant to be a permanent residence.

Most religions teach that an end of the world is coming. Regardless of religion, the universe is on track to become a dark, lifeless mass as the stars and galaxies die out. Everything is going to end, and what remains is the record of our deeds, kept by God. Even if we manage to create the greatest empire on earth, or write the most wonderful novel, none of our accomplishments will last.

One day the universe will shut down as if it never existed, and on that day what significance can our achievements have? This world is not meant as a permanent home of peace, but as a test. And a test requires that the possibility of failure should exist. If all humans acted according to God’s wishes, evil would not exist. But since God has given humans the freedom to disobey Him, they have the ability to do evil.

God is good, and evil is the absence of goodness, the same way that darkness is the absence of light. If God is Light, we cannot blame Him for the darkness we encounter when we turn away from Him, distance ourselves from Him, and act against His wishes.

Why didn’t God make the universe a place of wholesome goodness lacking in the possibility for evil? Because if evil could not exist, humans wouldn’t truly be free beings.

To be free, humans require the freedom to act against God along with the freedom to act for His sake. God wants to give humans perfect freedom to act and grow, so that they can be the best or the worst they want to be. Since humans have the freedom to act against God, and since to act against God is to create evil, humans have been given the freedom to create evil.

God did not make this world a perfect place because that is not its purpose. Imagine if you were a maker of creatures. If the creatures you made were controlled by their nature to do exactly what you put in them to do, they could never be truly your friends. They would be subservient robot-like machines that cannot help doing whatever you put in them to do.

But imagine if one day you wanted something more. You wanted to make creatures that could truly be your friends. The only way to have a true friend is to create a creature that can choose whether to be your friend or not. And so, you make creatures with free will, who can act according to whatever they wish, rather than according to your programming. Some of these creatures will choose to be your friends, others will ignore you, others will choose to be your enemies. They may fight among themselves, doing much evil to one another, and blaming you, their creator, for the evil they do, when in truth they should blame themselves, for they are the ones choosing to act the way they do. They have the freedom to be good, and many of them choose to be good, but some of them choose to be evil instead.

The only thing we can blame God for is His creating us and giving us the freedom to be evil. This is a pointless blame. This is our reality and our fate, we cannot escape it. We have been thrown into this game regardless of our wishes, a game that forces us to choose to be either good or evil. We can debate the ethics of forcing people to choose between good and evil. But at the end of the day, we are forced to play this game. There is no dropping out.

Our Creator has done this to us, possibly against our will, but we cannot get hung up over this fact, because our future holds something very important: Either eternal reward, or eternal punishment. Blaming God will not help our future. It may make us feel better now to hate God as so many do, but by making us think badly of God, this will reduce our chances of future success. The future is coming whether we want it to or not, and we have the power to make it a good or a bad future.

Not all evil is done by humans. Droughts, floods and other natural disasters can cause much evil and suffering, and we can lose loved ones through car accidents and illnesses. Why doesn’t God prevent these things from happening if He loves us? Because, in order for the testing hall that is this world to be a true and consistent place of testing, God shouldn’t interfere with the functioning of nature. The laws of nature should behave in such a way that makes sense even without reference to God. If we were as intelligent as we are, and yet we saw that nothing bad ever happened on earth, no car accidents, to illnesses, nothing, that everyone died in old age of natural causes, then this would be undeniable evidence of the existence of a higher power that protects humans.

God wants us to have the possibility of being atheists. It is one of God’s self-imposed rules that it should be impossible to directly detect His existence. And that requires that the functioning of this world should make perfect sense according to predictable scientific laws.

God wants us to believe in Him without seeing Him or knowing that He truly exists, because if it were possible to prove His existence, it would reduce our freedom to act against Him. God wants our universe to seem to make perfect sense without any necessity for His existence. This way we are given the freedom to discover Him and His Scriptures, and through our knowledge and conscience, we gain the ability to either follow His way or disbelieve in Him. Once we are given this knowledge, there is no turning away from the choice between good and evil.

God wants our test to be a perfect test, in which we have perfect freedom to be good or evil. This would allow us to take credit for our actions. If God’s existence were proven, we’d be turned into slaves who cannot help but do as He says. We’d become merchants who act in our best interests by following God’s commandments. This is not what God wants. God wants us to be honored creatures who befriend Him not because we are forced to, but because we choose to. This is what gives worth to our friendship.

There is little honor in an employee acting according to his or her boss’s wishes, this is the expected behavior. While even this amount of obedience to a boss justifies reward, so that even if we had proof of God’s existence, we could still be rewarded for obeying Him, God wants to take us beyond this boss-employee relationship. He wants to raise us to the status of honored friends, who act out of love and friendship, and out of our own efforts toward remembrance of God, rather than acting out of practical compulsion.

God wants us to be the servant who continues to love and serve his master, even though the master goes away for years, decades. What incredible honor and reward can await such a servant who faithfully loves and serves his absent master for 50 or 60 years, until he dies, even though the master never returns?

God, by creating the possibility for the existence of true friendship between Himself and the humans He created, had to also create the possibility for the existence of true enmity between Himself and them. He wanted friends, but He knew that they couldn’t truly be called friends unless they had the option to be His enemies.

The evil done by humans on Earth is a doing of humans when they act against God, it is not a doing of God, therefore humans should be blamed, not God. And the evil done by nature is nature’s own doing, caused by the rules of physics, and God does not want to interfere with it because constant interference with nature would cause His existence to become apparent. It is necessary for disasters and accidents to be possible, as these prove to us the validity of nature’s rules, and allows the atheist the freedom to use these to prove that God doesn’t exist.

God and Nature shall always be apart, or seem to be apart, so that each one appears to function without the other. This is necessary, as this is what enables humans the freedom to choose between faith and disbelief, between good and evil. The world needs to make perfect, logical sense without having to refer to God in our thinking. It should be possible for us to believe that the world functions on its own without anything supernatural existing, this is what gives us the freedom to believe and disbelieve in God.

We need to be able to believe that the Master is absent. This is when the true nature of the servant comes through. Bad servants start to misbehave as soon as the Master looks away, and if the Master is away long enough, they entirely give up serving Him. They will start to loot His property and defile His name. But the good and honorable servant, even as he sees all of this happen, continues to have love and loyalty toward his Master. It makes no difference to him even if the Master never comes back. He keeps the remembrance of his Master in his heart, and he admonishes and encourages himself to continue to be the best servant he can be.

The world, the way it is, gives us the perfect opportunity to be this honorable and admirable servant. If evil did not exist, and if bad things did not happen, then there would have been no way for such servants of God to exist. We’d instead all be lowly and menial servants who never had a chance to disobey, and thus never had a chance to prove our loyalty toward God.

A world without evil and disaster would be a dysfunctional testing hall that cannot differentiate between the best and the worst of us. Without evil and disaster, God’s existence would be so clearly visible to us that most of us would cower in front of Him. A few people might be found who are daring enough to disobey God even in such circumstances, but the majority of people would kneel before God as they would before a great emperor, regardless of whether they had any loyalty toward Him.

A world that seems to be ruled by the cold, harsh laws of nature, and that completely hides the existence of God from our eyes, gives us the perfect opportunity to prove our loyalty to God. This world, with all of its problems, is the perfect testing hall, because of the problems it has.

Why Bad Things Happen to Good People

I will get around the metaphysical complexity of defining good and bad people by saying that a good person is anyone the reader thinks does not deserve to suffer, while a bad person is someone who does not deserve God’s protection.

Why good people suffer has already been mostly answered. If bad things never happened to good people, this would act as a proof of God’s existence and the invalidity of nature’s laws. If all good people lived to old age and died of natural causes, this would be easily detectable by even the simplest analysis.

There are religious people who wrongly think that if you are truly faithful, you will never suffer anything bad. When they see bad things happen to people, they try to find the reasons why the sufferers themselves are responsible for the suffering that has come upon them.

But disasters are a natural part of life, and it should affect good and bad people equally, or at least it should seem to do so. God does not want to be seen, so it should be impossible to detect miracles happening to save good people.

The suffering of good people proves that nature’s laws are real. If nothing bad ever happened to good people, but only happened to bad people, the fact would act as a proof of God’s existence, and this is what God does not want in this world. God wants us to follow Him and serve Him of our own free will, without any compulsion or strong inducement.

There would be millions, maybe billions, more believers if avoiding suffering was as simple as believing in God and serving Him. But these believers would be tantamount to fair-weather friends, who are on the bandwagon of faith only for their own immediate, short-term interest. They wouldn’t be loyal friends of God.

The world should occasionally give the faithful the impression that God has abandoned them. This is the true test of faith. Once all blessing seems to have gone from our lives, that’s when we look inside our hearts to find God again. If we weren’t true believers, if we only believed in God to ensure our own worldly good, then there would be no God in our hearts. We’d lose faith and abandon religion once we had the impression that God has abandoned us, like millions do.

But as for the truly faithful, when life gives us the impression that God has abandoned us, we continue to believe in God and to do our best to protect our faith. If our Master seems absent, it does not mean He has gone away forever. Only a dishonorable servant would start to act as if the Master is dead once He is gone away for a month or two. Those of us who truly believe in God, who love Him and want His friendship, and who have accepted to be His servants for eternity, will not abandon serving Him, regardless of what hardship and loneliness comes our way.

By the morning brightness

And [by] the night when it covers with darkness,

Your Lord has not taken leave of you, nor has He detested [you].

And the Hereafter is better for you than the first [life].

And your Lord is going to give to you, and you will be satisfied.

Did He not find you an orphan and give [you] refuge?

And He found you lost and guided [you],

And He found you poor and made [you] self-sufficient.

[Quran 93:1-8]

The possibility of good people suffering something horrible is nothing but an extension of these facts of life; the need for a proof of nature’s laws, the necessity for some suffering to prove one’s faith and virtue. God can inflict the greatest suffering on His most beloved servants, as He did with Abraham when He asked him to slaughter his beloved son, and as He did was Jacob in allowing him to believe, for years on end, that his most beloved son was dead, as this is how the greatest friends of God are raised to the highest ranks.

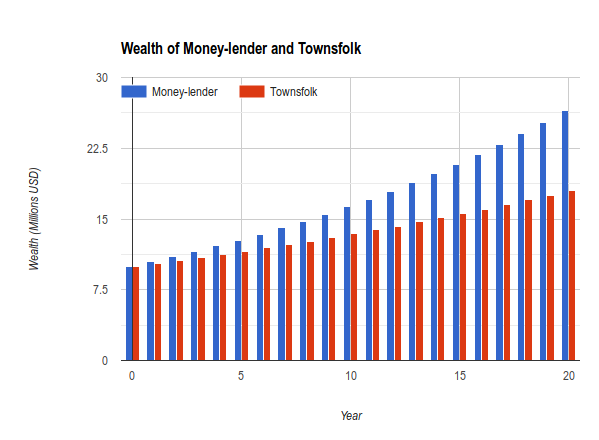

There can never be virtue without suffering. A virtuous act is one where we overcome our natural tendencies for the sake of God, and attaining virtue always has an element of suffering in it, small or great. A rich person who, out of love for God, refuses to practice usury to further enrich himself or herself, is doing a virtuous thing. Their suffering is that they watch their fellow rich men and women practice usury and see their wealth increase exponentially, while their own wealth increases slowly and is subject to far more risk.

And someone who attains virtue by working for a charitable cause, or by giving money to the poor, is also subject to a mild form of suffering (what economists would call “opportunity cost”), as they lose time and money that could have been used for something pleasurable.

The possibility of good people suffering does not mean that blessedness in this world does not exist. As in the story of Joseph, God will allow suffering to happen, followed by periods of ease and enjoyment, followed by more suffering, until His servant is raised to the highest possible status. God will not leave his faithful servants abandoned alone to be entirely subject to the cold, harsh laws of nature, though it is necessary that it should appear so, so that God’s existence will not become apparent. The Quran says:

Whoever does righteousness, whether male or female, and who is a believer - We will surely cause him to live a good life, and We will surely give them their reward [in the Hereafter] according to the best of what they used to do.

[Quran 16:97]

Besides reward in the afterlife, the verse promises a good worldly life. The word used in the verse to mean “good” is tayyib, which can also be translated as “wholesome”. God will have a hand in the lives of good people, ensuring that despite the disasters they suffer, they will end up having wholesome, blessed lives. This, of course, cannot be proven, in accordance with God’s plan. But it can be seen in little things for those of us who have faith. The lives of believers seem to have more purpose. Their life stories seem better arranged and guided. This of course cannot be proven to an atheist, and it doesn’t have to be.

On the other hand, for disbelievers, people who knowingly rebel against God even though they believe in Him in their hearts, the Quran has this to say:

But whosoever turns away from My Remembrance, verily for him is a life narrowed down, and We shall raise him up blind on the Day of Judgment. He will say: "My Lord, why have you summoned me as a blind person when I was sighted?" He will say: "Thus did Our signs come to you, and you forgot them; that is why you have been forgotten this Day."

[Quran 20:124-126]

This verse, similar to the previous one, implies that there are worldly consequences for having (and in this case, not having) faith. Those who knowingly reject God will have a “narrowed down” life, also translated as “straitened” and “constricted”. Similar to how the lives of good people are blessed despite their hardships, the lives of evil people are constricted despite their joys and pleasures.

To put it another way, the general theme of a believer’s life is blessedness, while the general theme of a disbeliever’s life is constrictedness, a feeling of being oppressed by life. Both will enjoy periods of joy and periods of suffering, but through submitting to God, believers are blessed by God and are freed from many of the constraints of life, while disbelievers are, in general, and not very detectably, made to submit to the harshness and coldness of nature.

There will be a hidden hand of God that shields and guides the believer, while there is no such shield and guide for the disbeliever, and the world, itself a servant of God, treats them the way they like to be treated, as if God does not exist.

God could inspire us to always make the right choices in order to avoid all that is bad and to always gain what is good. But, besides making God’s existence apparent, this would reduce the value of our friendship with Him. A true friend of God is the one who keeps his faith in Him during difficulties, while a fair-weather friend of God is the one who only loves and worships God during times of peace and plenty, and whose faith is shaken whenever something bad happens to them (and plenty of such believers do exist).

The matter of ranks of God’s chosen friends in the afterlife is important, because it decides a person’s status in the afterlife for all of eternity. God does not want most of us to leave this world without having proven how good of a friend of God we are. That, in fact, is the main purpose of this world: To distinguish our ranks, from the very best of us to the very worst.

Some people die before they can prove themselves to God, for example infants. God allows this to happen because infant deaths are required by the laws of nature. And as for the poor infant, while their death is a tragedy in this life, in the afterlife God can choose to give them great reward without them having worked for it, since God’s generosity is not limited. He may also give them a higher status in the ranks of His friends than their parents as a reward for the parents, while also raising the status of the parents who kept their faith during the ordeal. A truly just God will not let an infant’s death go to waste.

There are a thousand ways in which God can preserve eternal justice while allowing tragedies like infant deaths to happen, since this life is no more than a mere flicker compared to the eternity of the afterlife, and everything that happens here will one day be nothing more than a pale memory when a person has spent millions of years enjoying the rewards of the afterlife, close to family and friends and close to God.

Suffering is a natural part of a believer’s life. God does not ask us to stoically control our emotions, never letting any suffering show, to prove that we are faithful. Jacob was a prophet of God, and yet he cried so much after his son was believed dead that his eyes turned blind. There is no shame in sadness. God does not ask us to be super-human, but to keep faith alive in our hearts as we are subjected to life’s joys and sorrows.

Isn’t it Unkind for God to Punish His Creatures?

Think of God as Light. By staying close to Him, by following His commandments, we ensure our eternal good. No one is perfectly close to Him, each person is at some degree of distance. Eternal punishment is only for those who knowingly stray so far away from the Light that they knowingly wallow in complete darkness. Anyone who stays within the merest flicker of Light may gain God’s forgiveness and eternal reward.

Eternal punishment is necessary because that is the only way of ensuring that evil-doers don’t get away with their evil deeds. Many Jews (and Christians too) have become corrupted by the idea that they are God’s chosen children and that no matter what they do, they will eventually be forgiven. This is a highly dangerous thing to believe, because once you believe that you will never be punished eternally, then you can get away with anything. If you are an Israeli settler, who cares if you take over other people’s lands with violence. You are God’s Chosen, and you will be forgiven.

Once the idea of eternal justice is corrupted, then from that all evil follows. Even if people believe in an afterlife, if they think that there will be a limit on their punishment term, that they will burn for a thousand years and then will be freed to enjoy life for the rest of eternity, then many of them will not find it so bad to devolve utterly into sin, since they will eventually get away with it.

To preserve justice, people should not be able to get away with their crimes. During their lifetimes God gives them thousands of opportunities to repent and become better people. God believes that a human lifetime is sufficient to distinguish good people from bad, that it contains enough opportunities for humans to prove whether they deserve eternal good or eternal punishment. Every hour of every day contains opportunities for us to change, for better or for worse, and these small changes mount. There is a Light in this world and we can choose to either walk toward it or away from it every hour of every day. Every time we take a step away from it, we do it in the full knowledge that we have the chance to take a step toward it instead.

If we spend all of our lifetimes walking away from the Light by knowingly doing evil, we shouldn’t be surprised when one day we find ourselves in total darkness, hopeless of ever finding the Light again. It was our own choices that brought us here. For years and decades we had the option to turn back and walk toward the Light again, our consciences kept reminding us that we still had a chance to return to God, that God’s door was wide open to us, but instead we decided to keep walking away, chasing our shadow instead of chasing the Light.

Once a person falls into total darkness through their own choices, there will no longer be a point to extending their lives to let them come back. This is what Scripture claims, that once a person is totally surrounded by their evil deeds, they will never come back toward the Light. There is a point of no return, meaning that a person who crosses this point, even if given a lifetime of a hundred thousand years, it will not make a difference in their fate.

In fact, the Quran claims that such evil people, even if taken to the afterlife and shown all of the signs of God’s greatness, then brought back to earth, they will continue to be evil. Among some Christians there is the belief that people, no matter how bad, can be made to become good through education and reformation. The Quran, always unabashedly realistic, has a more satisfactory view, that guidance can only be had with God’s blessing, that even if someone fully understands God and believes in Him, they can still choose to be evil. The Quran goes beyond this, saying that once a person fully devolves into evil, not only will they become unreformable, but that God will actively prevent any reform, because they’ve done sufficient evil to seal their fate (as in the case of the Pharaoh of Egypt in the story of Moses).

If you could but see when they are made to stand before the Fire and will say, "Oh, would that we could be returned [to life on earth] and not deny the signs of our Lord and be among the believers."

But what they concealed before has [now] appeared to them. And even if they were returned, they would return to that which they were forbidden; and indeed, they are liars.

And they say, "There is none but our worldly life, and we will not be resurrected."

If you could but see when they will be made to stand before their Lord. He will say, "Is this not the truth?" They will say, "Yes, by our Lord." He will [then] say, "So taste the punishment because you used to disbelieve."

Truly, they have lost, those who deny the meeting with God , until when the Hour [of resurrection] comes upon them unexpectedly, they will say, "Oh, [how great is] our regret over what we neglected concerning it," while they bear their burdens on their backs. Unquestionably, evil is that which they bear.

And the worldly life is nothing but amusement and diversion; but the home of the Hereafter is best for those who fear God, so will you not reason?

[Quran 6:27-32]

The average person might be a sinner, but they do not fight against God every chance they get, and at the time of death they will likely possess enough light to be eligible for God’s forgiveness.

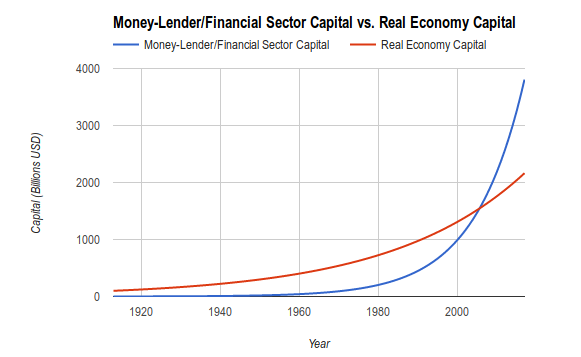

What are some examples of people who deserve eternal punishment? Usurers and their central bankers, who knowingly enslave millions to an evil, unnatural type of debt to enrich themselves, who orchestrate economic bubbles and bursts to reap trillions of dollars in profit while destroying the livelihoods of millions of families, and who plunge countries like the US into war after war, knowing that hundreds of thousands of innocent people will be killed, just so that they can earn their trillions financing these wars. A just God will not let these people go unpunished, and their punishment will not be something they can laugh at, it will not be a slap on the wrist like the US government gives to the usurers at Goldman Sachs every year when they are caught manipulating markets and destroying parts of the economy to enrich themselves. It will be something that will make them cry every single day for eternity.

I will not believe in a God who lets these people get away with the immense evil they do.

Conclusion

People make the mistake of considering this world their permanent home. They become attached to its blessings and disasters, and they think they can judge God based on what happens in their lives. But this world is nothing more than a tool for distinguishing God’s true friends from His fair-weather friends, and distinguishing these from His true enemies.

This world is nothing more than a preparation for the eternity of the afterlife. We would be wise not to become attached to its ups and downs, and to know that these are the days given to us by God in which we can prove ourselves to Him.

***

I originally published this essay as a short ebook on Amazon in 2015. I’ve decided to publish it for free here on my website, after thoroughly rewriting it, so that more people may (hopefully) benefit from it.

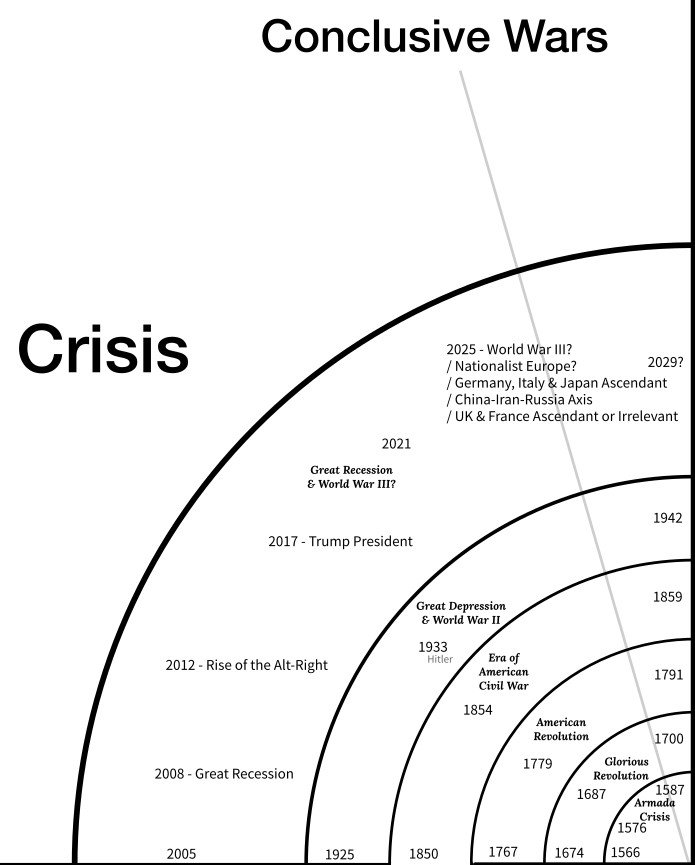

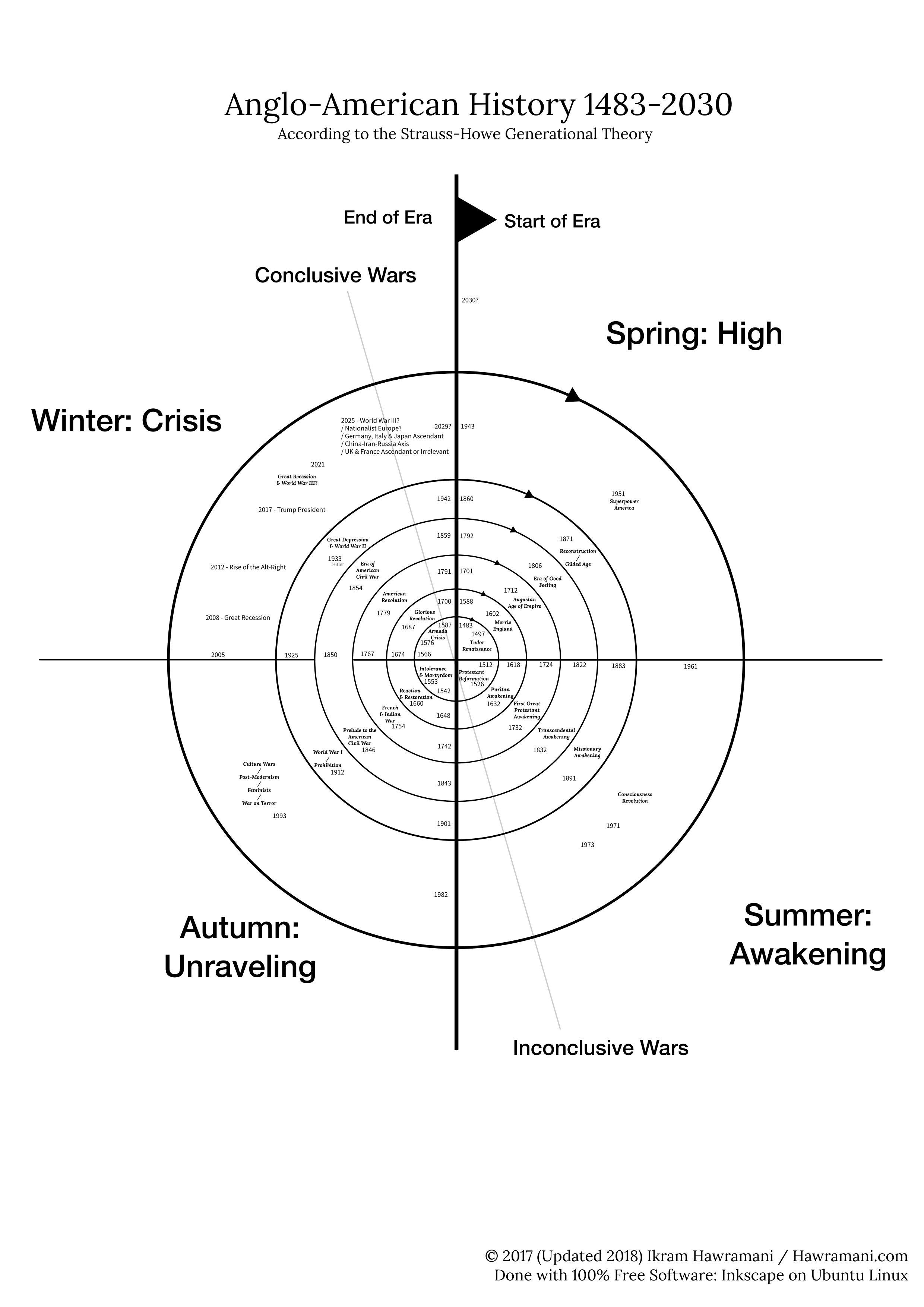

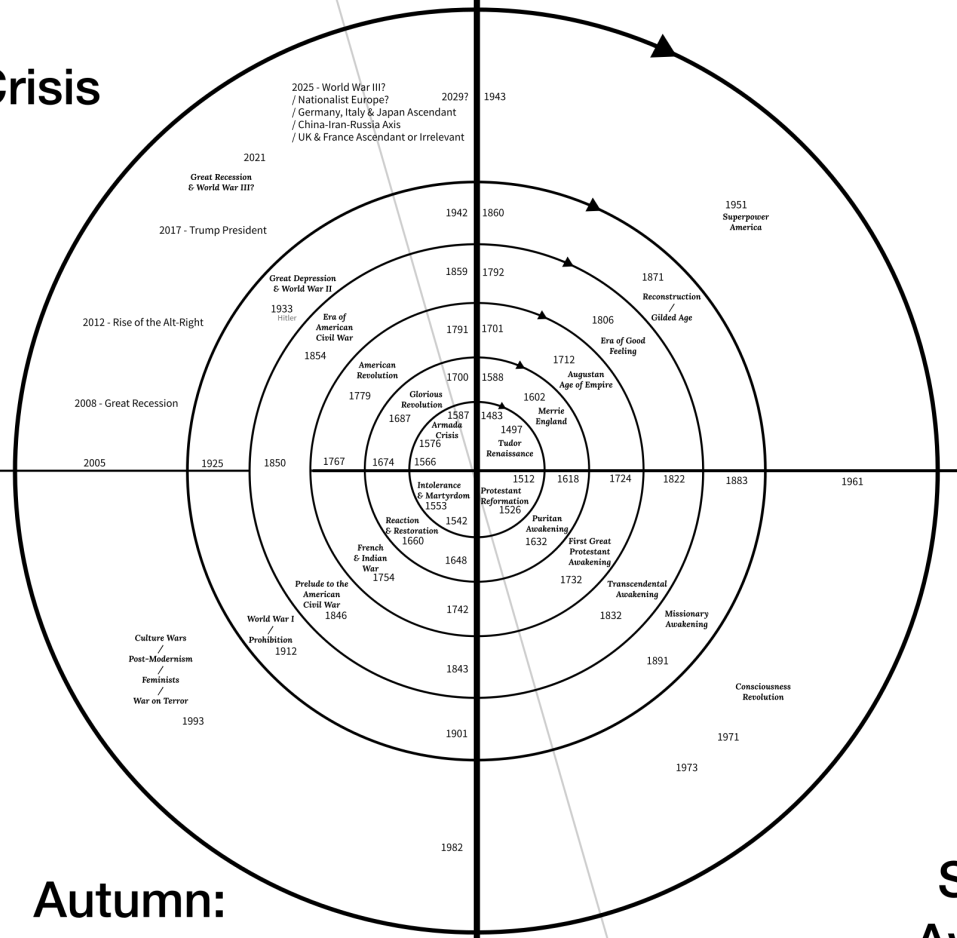

The “saeculum” is the word that Strauss-Howe use for each circle of the chart above, four seasons together make one saeculum. A saeculum is generally the length of one human life time, and its regularity has been noted since ancient times. We are currently living at the end of the saeculum that started in 1943, and which will probably end sometime between 2025 and 2035.

The “saeculum” is the word that Strauss-Howe use for each circle of the chart above, four seasons together make one saeculum. A saeculum is generally the length of one human life time, and its regularity has been noted since ancient times. We are currently living at the end of the saeculum that started in 1943, and which will probably end sometime between 2025 and 2035.